Project finance transactions often involve a labyrinthine framework, necessitating meticulous planning and execution. Lenders typically demand comprehensive due diligence to mitigate exposure. A well-structured transaction typically entails multiple vehicles, including debt, equity, and security. Parties involved must collaborate to ensure harmony on objectives. Effective exchange is paramount throughout the progression of the project.

- Intricate legal documentation is essential to define the rights and obligations of all players.

- Solid financial modeling provides a template for analyzing income generation and evaluating project feasibility.

- Regulatory considerations can be particularly demanding, requiring expert counsel.

Infrastructure Projects: Navigating Risk and Return

Successfully implementing infrastructure projects requires a meticulous assessment of both risk and return. These ventures often involve substantial investment, coupled with inherent uncertainties stemming from geopolitical fluctuations, technological advancements, and unforeseen events. Due diligence is paramount to protect project viability. A thorough grasp of potential obstacles allows for the adoption of appropriate safeguards, reducing the consequences of unforeseen events. Simultaneously, a clear model check here for measuring return on investment is essential to justify resource allocation and demonstrate the project's future value proposition.

- Strategic planning should encompass a range of potential scenarios, allowing for resilient decision-making in reaction unforeseen circumstances.

- Open communication with stakeholders, including investors, regulators, and the public, is crucial to build trust and address expectations throughout the project lifecycle.

Project Finance: A Guide to Due Diligence and Investment Decisions

Undertaking project finance ventures necessitates a meticulous approach to due diligence and investment decisions. Thorough/Comprehensive/Meticulous examination of potential projects is crucial to mitigate risks and ensure successful outcomes. Investors must carefully analyze/rigorously scrutinize/thoroughly evaluate key factors such as the project's soundness, market demand, financial projections, and regulatory environment. A robust/comprehensive/in-depth due diligence process encompasses/includes/covers a variety of aspects, including legal reviews, technical assessments, environmental impact studies, and cash flow analysis. By conducting/performing/implementing a robust due diligence exercise, investors can make informed/strategic/sound investment decisions that maximize potential returns while minimizing/mitigating/reducing risks.

Ultimately, success in project finance hinges on a holistic/integrated/comprehensive understanding of the project's complexities and a disciplined/structured/systematic approach to due diligence and investment analysis.

Innovative Financing Models for Large-Scale Development

Securing substantial funding to facilitate large-scale development projects presents a significant hurdle. Traditional funding sources often fall limited in meeting the immense financial requirements of such endeavors. Consequently, innovative financing models have emerged as essential tools to bridge this gap and propel sustainable growth. These models embrace a diverse range of mechanisms, like public-private partnerships, impact investing, blended finance, and crowdfunding, to attract capital from a wider pool of sources. By leveraging these creative approaches, development projects can access the necessary capital to achieve their ambitious goals and drive positive social and economic transformation.

Unlocking Capital for Renewable Energy Projects

Securing capital for renewable energy endeavors is crucial to spur the transition to a sustainable future. Investors are increasingly understanding the potential of this industry, but obstacles remain in accessing adequate capital.

Regulators can play a crucial role by establishing supportive policies that encourage investment in renewable energy. These initiatives may include {taxcredits, feed-in tariffs, and grant programs.

Furthermore, the growth of innovative funding mechanisms is essential to attract capital towards renewable energy projects. These mechanisms may include {green bonds, crowdfunding platforms, and impact investing funds.

Finally, raising knowledge about the importance of renewable energy investment among the general public is vital.

Multilateral Institutions and Project Finance: A Vital Role

Multilateral bodies play a pivotal part in driving project finance, especially in developing regions. These entities, such as the World Bank and the Asian Development Bank, extend a range of monetary mechanisms to boost economic growth. Through credit facilities, aid programs, and technical assistance, they reduce financial obstacles and enable the execution of critical projects in energy. By promoting accountability, multilateral institutions also play a part to ensuring that project finance is used effectively and sustainably.

Kel Mitchell Then & Now!

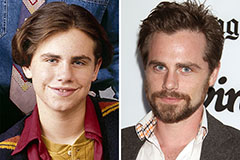

Kel Mitchell Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!